- The Crimson Insider

- Posts

- The Crimson Insider (V. #2)

The Crimson Insider (V. #2)

Insights and happenings from the Harvard startup & VC ecosystem

👋 Hello, Insiders! We’re officially in Q3. Only 89 days left until the new year - you got this! Welcome back to The Crimson Insider. We’re dedicated to bringing you insights and the latest from Harvard’s startup and VC ecosystem, among other exciting news.

Consider giving us a follow on X (Twitter) and LinkedIn. Was this email forwarded to you? Click here to subscribe. Be a great friend and share The Crimson Insider with your sectionmates!

Have a tip, congratulations to give, or want to be featured? Click here.

Breaking News🥳

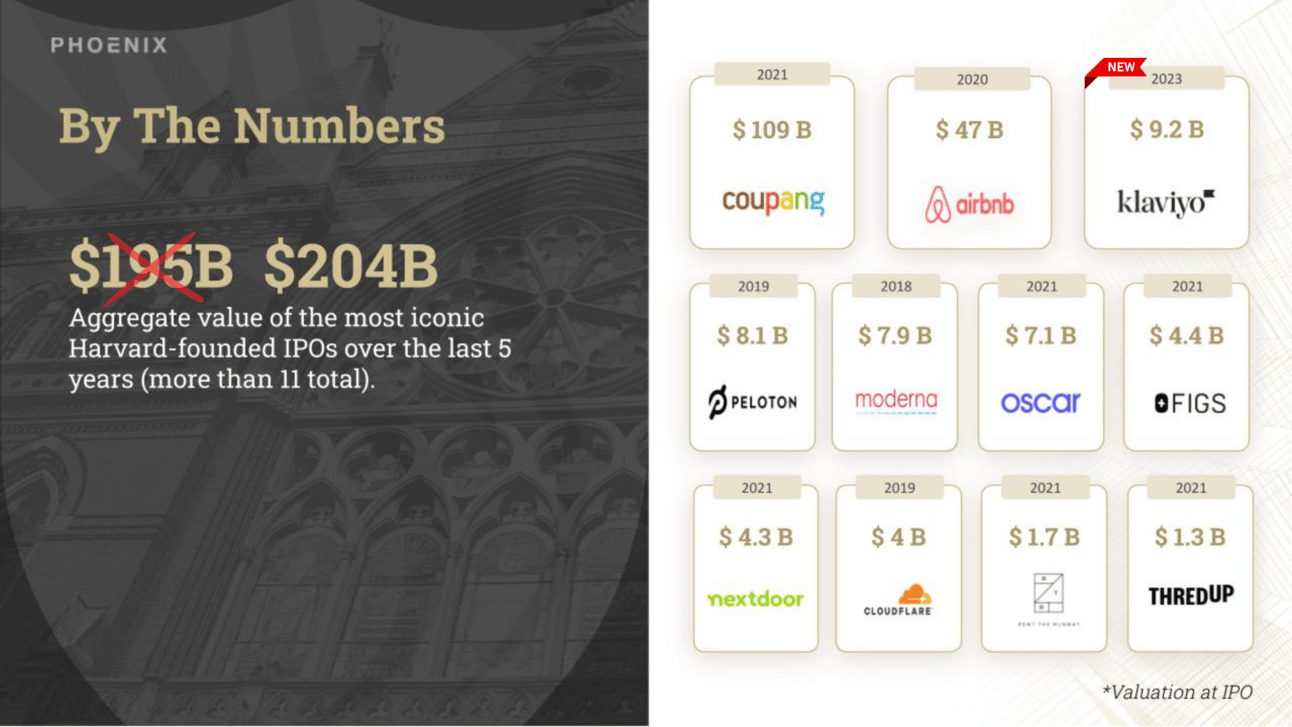

Harvard has officially minted yet another Unicorn (nearly a Decacorn): Klaviyo! Founded by Andrew Bialecki (Harvard College, 2007), Klaviyo was valued at $9.2B after selling shares at $30 a piece during its IPO late last Tuesday.

Klaviyo is a powerful marketing platform that helps ecommerce store owners deliver a more personalized experience for their customers. Results speak for themselves - Klaviyo has helped brands across the world make more than $3.7B in revenue in the last year alone.

Klaviyo’s IPO brings the aggregate value of the 11 Harvard-founded tech IPOs in the last five years to $204B! Can you believe this figure?!

Phoenix Fund Research

In many ways, Klaviyo was a masterclass of lessons for startups and founders. Among the most important insights gleaned was capital-efficiency; Klaviyo’s Founder, Andrew, IPO’d with 38% of a well-poised $10B company! Here are some great resources for learnings:

🔗 Link: Klaviyo IPO | S-1 Breakdown, by Meritech

🔗 Link: LinkedIn post written by Jeffrey Noonan (HBS, 2024)

🔗 Link: LinkedIn post written by Edward Chiu

Andrew Bialecki, Co-Founder & CEO, Klaviyo

Andrew Bialecki is the Co-Founder and CEO of Klaviyo. Prior to Klaviyo, Andrew was the CTO at RockTech and Lead Engineer at Applied Predictive Technologies. He is a fellow alumni of Harvard University (2007), earning his BA in Physics and Astronomy & Astrophysics.

Recent Harvard Financings / News 💸

🚀 Writer raised a $100M Series B, led by ICONIQ Growth. Founded by May Habib (Harvard College), Writer is the only full-stack generative AI platform with the quality and security required in the enterprise. More here.

🚀 Cartwheel raised a $20 Series A, led by Menlo Ventures. Founded by Joe English (HBS), Cartwheel helps school tackle the student mental health crisis. More here.

🚀 Proven Skincare raised a $12M Series A, led by existing investors. Founded by Ming Zhao (HBS), Proven Skincare is a customized beauty company. More here.

🚀 Botbox raised a $12M Series A, led by Playground Global. Founded by Austin Oehlerking (HBS, 2016), Botbox helps last mile carriers increase productivity at a significantly lower cost. More here.

To-date, Phoenix Fund has invested in 145 Harvard-Founded Startups. Know a pre-seed or seed founder we should meet? Please reply to this email or send us a note: [email protected]

HBS Unicorn Fun Facts 🏆️

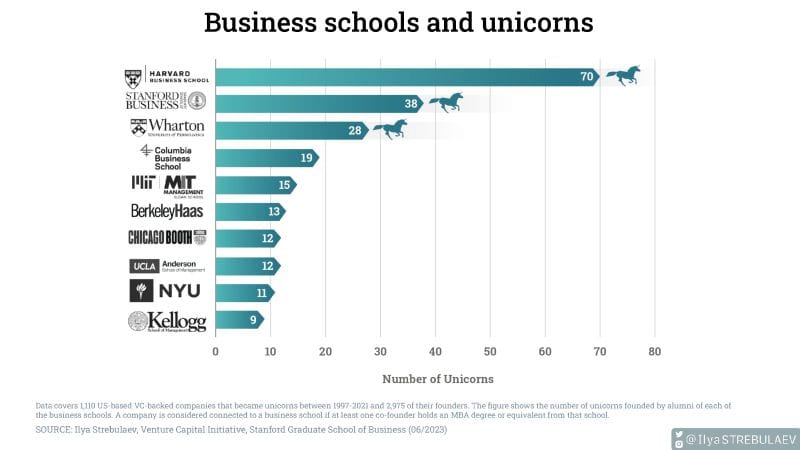

323 (29%) out of 1,110 US-based VC-backed unicorns have at least one founder who went to a business school. Out of these, 70 (22%) have founders from HBS. Will you be next?!

Celebrating Your Peers 🎉

Maneesha Ghiya (HBS, 2005), Founder & Managing Partner of FemHealth Ventures, closed a $32 million fund for women’s health investments. More here.

Ryan Isono (Harvard College) was promoted to Deal Partner at Felicis, a Bay Area-based globally focused venture firm.

Richie Serna (Harvard College, 2010) sat on a TechCrunch panel to discuss building an equitable cap table. More here.

William Hess (HBS, 2023) joined the Investment Team at 645 Ventures as a Senior Associate.

Margaret Wang (Harvard College, 2009) joined Recharge Capital as a Managing Director to lead women’s healthcare.

Ashutosh Kumar - Jha (HBS, 2023) assumed the Chief of Staff role at Expert Dojo, an international early-stage accelerator.

Michael Izard (Harvard College) announced the launch of Helm Capital Partners, an independent advisory firm offering M&A and capital raising services to middle-market TMT companies. More here.

Juan Ignacio Perez-Gea (HBS, 2023) announced the launch of Karakoram Capital, a search fund seeking a small- to medium-sized business. More here.

Zipporah Nyokangi (HBS) announced the launch of Etago Capital, a search firm looking to acquire a company based in the US or Canada. More here.

16 Harvard/HBS alumni named Business Insider’s 68 most important VCs in NYC:

Hayley Bay Barna (Harvard College + HBS), Partner at First Round Capital

Rob Biederman (HBS, 2014), Managing Partner at Asymmetric Capital Partners

Peter Boyce II (Harvard College), Founder of Stellation Capital

Sandy Cass (Harvard College, 1999), Managing Partner of Red Swan Ventures

Stuart Ellman (HBS, 1992), Co-Founder & General Partner at RRE Ventures

David Haber (Harvard College), General Partner at Andreessen Horowitz

Merritt Hummer (HBS), Partner at Bain Capital Ventures

Rebecca Kaden (Harvard College, 2008), General Partner at Union Square Ventures

Josh Kushner (Harvard College), Founder of Thrive Capital

Jessica Lin (Harvard College, 2009), Co-Founder & General Partner at Work-Bench

Chris Paik (Harvard College, 2009), General Partner at Pace Capital

Micah Rosenbloom (HBS, 2003), Managing Partner at Founders Collective

Caitlin Strandberg (HBS, 2016), Partner at Lerer Hippeau

Jarrid Tingle (HBS, 2019), Co-Founder & Managing Partner at Harlem Capital

Alexa von Tobel (Harvard College + HBS), Founder & Managing Partner at Inspired Capital

Ellie Wheeler (HBS, 2011), Partner at Greycroft

VC Spotlight 📣

Founder Collective Fund I ($50M)

Co-Founded by David Frankel (HBS, 2003) & Eric Paley (HBS, 2003)

🦄 count: 4 Decacorns

Invested in the seed rounds of: Uber ($95.8B Market Cap), The Trade Desk ($41.5B Market Cap), Coupang ($33B Market Cap), Airtable ($11B Latest Valuation), Seatgeek ($1B Latest Valuation), and Riskified ($818M Market Cap).

Data source: Harry Stebbings, LinkedIn

Community Updates 🧑🤝🧑

Views from Phoenix’s SF dinner with legendary investor, Kevin Hartz

Throwback to Phoenix’s SF dinner with Kevin Hartz, Founder of Xoom (IPO, 2013) & Eventbrite (NYSE: EB) and early investor in PayPal, Airbnb, Pinterest, Uber, and Ramp, among many others.

Phoenix’s aim is to foster community among Harvard founders, investors, and alumni to offer a rewarding extension of the Harvard experience. Stay tuned for future events - we hope to see you soon.

What’s Happening at Harvard? 🤔

🔗 Link: Harvard University inaugurated 30th president Claudine Gay, the first Black person and second woman to lead the university.

🔗 Link: Harvard will no longer ask for Seniors to contribute to the “Senior Gift Fund.” That’s right - Harvard suspended this decades long tradition amid low student buy-in.

🔗 Link: Oprah Winfrey was on campus at HBS last week sharing a conversation with Jeffrey Goldberg about the pair’s new book, Build the Life You Want: The Art and Science of Getting Happier.

Phoenix Library 📚️ 🎙️

🎙️ Great Listens

🔗 Link: Venture Capital and Investing: How Floodgate Differentiated Again From Thousands of Seed Firms. Featuring Mike Maples, Jr (HBS, 1994)

🔗 Link: The Peel: How Semil Shah Build Haystack. Featuring Semil Shah (Harvard College, 2008)

📚️ Great Reads

🔗 Link: Higher Purpose Venture Capital: Fifty Venture-Backed Startups that are Uplifting Humanity Through Social and Financial Inclusion” by entrepreneur and venture capitalist Ron Levin (HBS, 2008) has been released worldwide. This book examines the power of private investment and entrepreneurship to generate wellbeing and drive positive change through “double bottom line” early-stage technology ventures that address problems related to social and wealth inequality.

🔗 Link: Why Do Investors Care So Much About LTV:CAC?

🤜 Did you enjoy The Crimson Insider? Share with your sectionmates & consider replying to this email with your feedback. Thanks!

Cheers,

Anthony, Chloe, & Devon

Phoenix Investment Fund