- The Crimson Insider

- Posts

- The Crimson Insider (V. #4)

The Crimson Insider (V. #4)

Insights and happenings from the Harvard startup & VC ecosystem

👋 Hello, Insiders! Welcome back to The Crimson Insider. Very exciting content today so be sure to read in full. As always, we’re dedicated to bringing you the latest from Harvard’s startup and VC ecosystem.

Consider giving us a follow on X (Twitter) and LinkedIn. Was this email forwarded to you? Click here to subscribe.

Recent Harvard Startup Financings / News 💸

🚀 John Foley (HBS, 2001), Founder of Peloton, announced that he is starting a new company to sell rugs! More here.

🚀 Capchase was identified by Forbes in their 2023 list of “Next Billion-Dollar Startups.” Founded by Miguel Fernandez (HBS), Capchase provides financial solutions to help SaaS companies grow faster. Capchase was last valued at $675M during their Series B raise in 2022. More here.

🚀 Prequel raised a $5.2M Seed led by NextView Ventures and Stage 2 Capital with participation from YC and Script Capital. Founded by Charles Chretien (HBS, 2021), Prequel allows a single API to integrate with any database, data warehouse, or other data storage. More here.

🚀 Allara raised a $10M Series A led by Google Ventures. Founded by Rachel Blank (HBS, 2018), Allara is the first collaborative care platform for women with chronic health conditions. More here.

🚀 Prove raised $40M in funding led by Capital One Ventures and MassMutual Ventures. Founded by Rodger Desai (HBS, 2003), Prove is a digital identity authentication tool used by 1,000+ entities. More here.

🚀 Upfort raised an $8M Series A. Founded by Xing Xin (Masters, 2014), Upfort is a leading platform for cyber security and insurance that provides holistic protection from evolving cyber threats. More here.

🚀 Prism Data raised a $5M Seed led by Obvious Ventures and Citi Impact Fund. Founded by Jason Rosen (HLS, 2012), Prism Data is a software platform that helps to analyze financial transaction data. More here.

To-date, Phoenix Fund has invested in 152 Harvard-Founded startups. Know a pre-seed or seed founder we should meet? Please reply to this email or send us a note: [email protected]

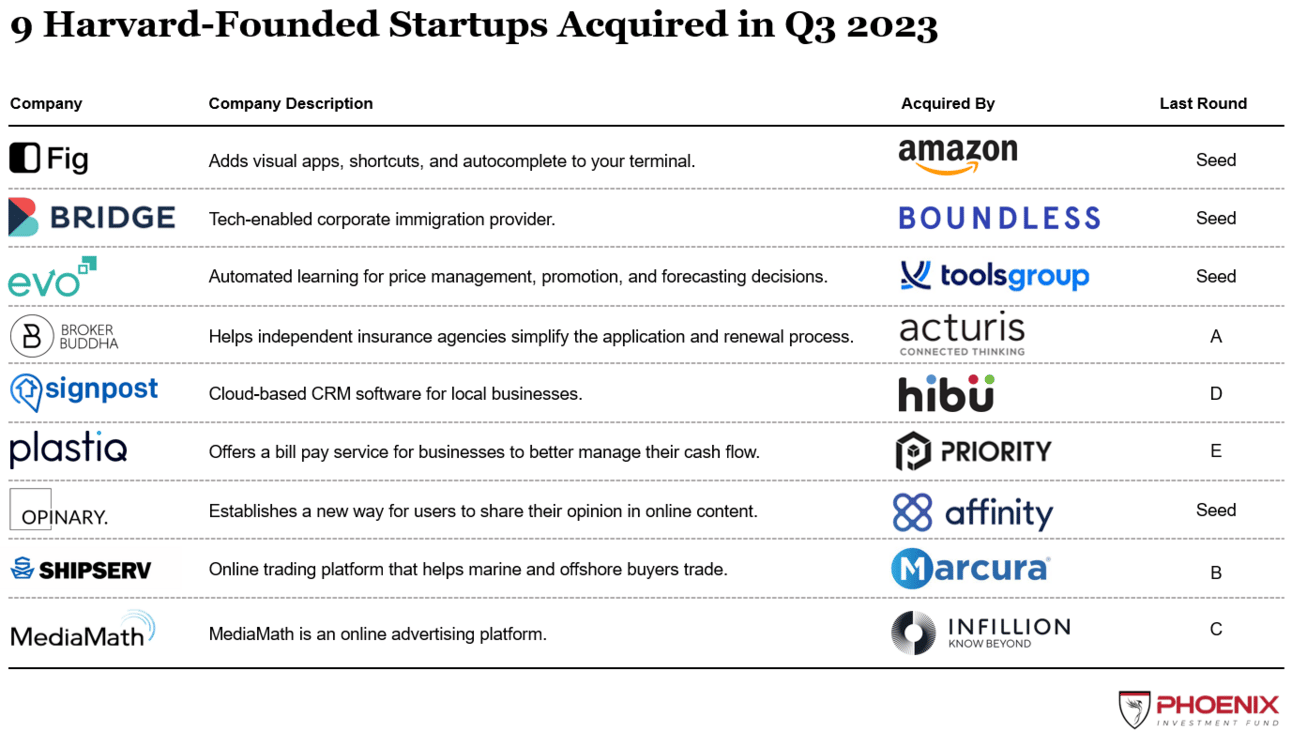

📣 9 Harvard-Founded Companies Acquired in Q3 2023

The M&A market has been closed for quite some time as buyers and sellers look for clarity around valuation. However, we saw a decent uptick in activity coming out of the summer, and are glad to share that 9 of your peers successfully completed acquisitions.

Source: Phoenix Fund Research

*If you have additional information or believe that a company is missing from this list, please let us know by replying to this email.

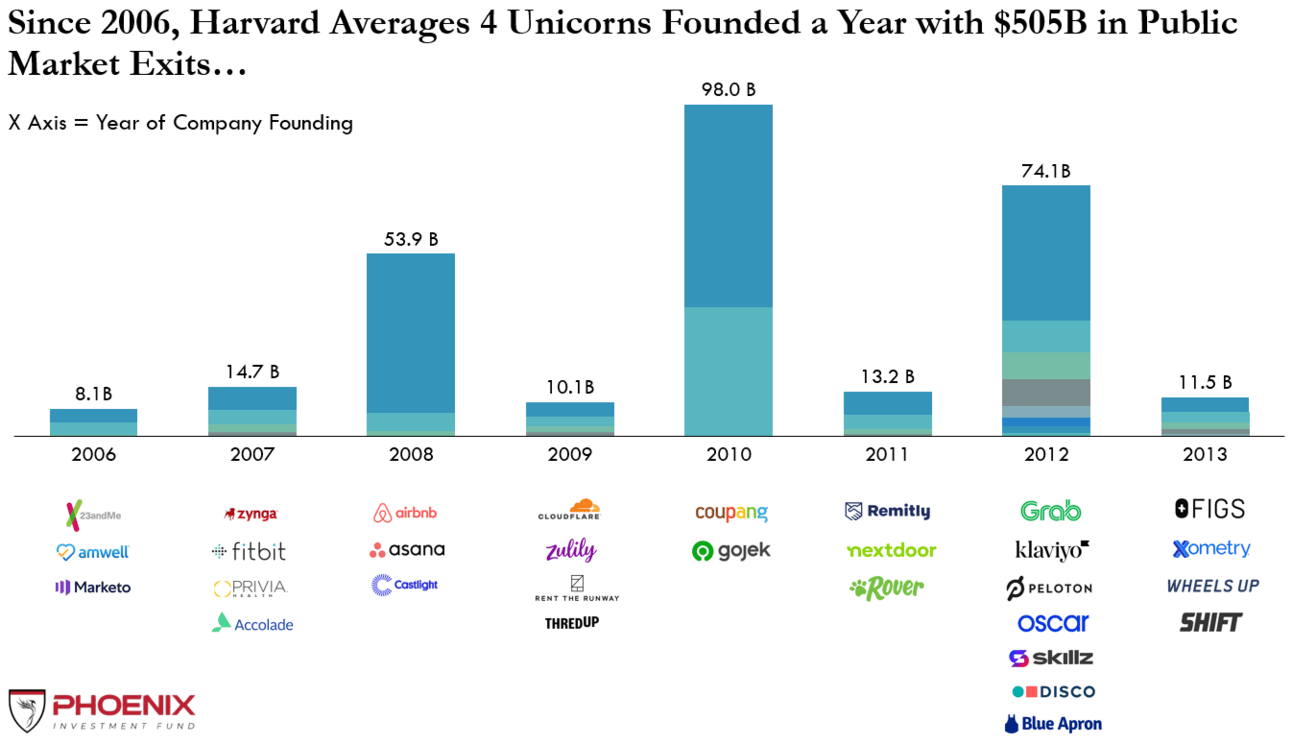

🫢 Harvard Births How Many Unicorns A Year?!

Our team was curious to investigate the annual birthrate of public unicorns within the Harvard ecosystem. According to our analysis, 4 new unicorns are born from the Harvard ecosystem each year.

Even more notably, the cumulative IPO valuations of these companies since 2006 have exceeded $500 billion, emphasizing the profound impact of you and your peers in nurturing successful startups and contributing significantly to the global economy.

Source: Phoenix Fund Research

Celebrating Your Peers 🎉

Marshall Plumlee (HBS, 2024), a former Professional Basketball player (Knicks, Clippers, & Bucks) and US Army Ranger, was featured in a GQ article. More here.

Rafael Corrales (HBS, 2010) raised $10.3M for Background Capital’s fourth fund, backed solely by top founders, executives, and super connectors. More here.

Arjuna Costa (HBS, 2001), Managing Partner at Flourish Ventures, raised a new $350M fund focused on FinTech investments with an opportunity to “create systemic change” and “build a more fair financial system.” More here.

Barr Even (HBS, 2017), Co-Founder & Managing Director of Rebalance Capital, is raising up to $100M for its debut fund. Barr previously led Private and Impact Investments at the Dalio Family Office (Ray & Barbara Dalio).

Grace Chen (HBS, 2023), announced the launch of a private investment fund, QCap. More here.

Philip Bilden (HBS, 1991), Founder & Managing Partner at Shield Capital (former Co-Founder of HarbourVest), announced the close of his $186M inaugural fund, 55% oversubscribed. More here.

*Please reply to this email with a tip / celebration to share

🥂 Business Insiders Most Important VCs in Boston

Pictured left to right: Rob Go (HBS, 2007), Payal Agrawal Divakaran (HBS, 2015), Chip Hazard (HBS, 1994), Ellen Chisa (HBS)

It comes with no surprise that Harvard alumni cover the list of most important VCs in Boston, and in large numbers. This year, 15 of your peers were featured.

Click here for an Airtable view of Boston’s most important VCs.

What’s Happening at Harvard? 🤔

🔗 Link: HBS partners with BCG on AI Productivity Study.

🔗 Link: Shark Tank Investor Kevin O’Leary judges pitches, awards $100,000 at HBS event.

Phoenix Library 📚️ 🎙️

🎙️ Great Listens

🔗 Link: Ed Sim (College, 1993): Why Seed Has Never Been More Competitive & Why Pricing Has Never Been Higher | E1076

🔗 Link: Rick Buhrman (HBS, 2005) and Paul Buser (HBS, 2009) - Find Your X, Nurture Your N

📚️ Great Reads

🔗 Link: Quick & insightful post on the progression of multiples across a companies life, from seed to post-IPO.

🔗 Link: All Revenue is Not Created Equal: The Keys to the 10X Revenue Club, by Bill Gurley (Partner, Benchmark)

🤜 Share The Crimson Insider with 5 HBS students or alumni and receive a $75 digital gift card!

Cheers,

Anthony, Chloe, & Devon

Phoenix Investment Fund